Paying attention to volume figures is really important at this stage.

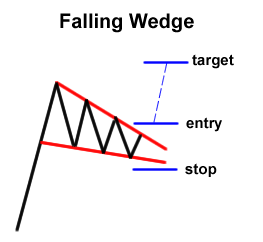

Once we spot a falling wedge that fulfills all criteria, we start focusing on the main elements of a trade: entry, stop loss and take profit, as well as the overall risk associated with this trading opportunity. Let us now look at the same example from a more technical trading perspective. The surge in volume comes around at the same time as the break out occurs. Just before the break out occurs and as the two trend lines get close to each other, the buyers force a break out of the wedge, surging higher to create a new low. In parallel, you see that the volume decreases. The pair’s price then starts to move lower, i.e.: the consolidation phase starts as the buyers use this time to regroup and prepare for another press higher. The price action moves in an uptrend, pushing higher and creating new short-term lows. In the chart above we see a EUR/USD on a daily chart. For this reason, we have two trend lines that are not running in parallel.

#Falling wedge series

In a channel, the price action creates a series of the lower highs and lower lows while in the descending wedge we have the lower highs as well but the lows are printed at higher prices. It’s important to note a difference between a descending channel and falling wedge. The second phase is when the consolidation phase starts, which takes the price action lower. The price action trades higher, however the buyers lose the momentum at one point and the bears take temporary control over the price action. The most common falling wedge formation occurs in a clean uptrend. For this reason, you might want to consider using the latest MetaTrader 5 trading platform, which you can access here. It may take you some time to identify a falling wedge that fulfills all three elements. The first two elements are mandatory features of falling wedge, while the occurrence of the decreasing volume is very helpful as it adds additional legitimacy and validity to the pattern. There is a decrease in volume as the channel progresses.There are two trend lines (the upper and lower) that are converging.The price action temporarily trades in a downtrend (the lower highs and lower lows).Hence there are three key characteristics of a falling wedge pattern: Following the consolidation of the energy within the channel, the buyers are able to shift the balance to their advantage and launch the price action higher. One of the key features of the falling wedge pattern is the volume, which decreases as the channel converges. The consolidation part ends when the price action bursts through the upper trend line, or wedge’s resistance. Within this pull back, two converging trend lines are drawn. To limit potential loss when price suddenly goes in the wrong direction, consider placing a stop order to buy back a short position or sell a put option at or above the breakout price.The falling wedge pattern occurs when the asset’s price is moving in an overall bullish trend before the price action corrects lower. The pattern height is the difference between the highest high and the lowest low within the pattern, and the breakout level is the lowest point within the triangle. To identify an exit, compute the target rice by subtracting the pattern height from the breakout level. Consider selling a pair short or buying a put option at the downward breakout price level. If the price breaks out from the bottom pattern boundary, day traders and swing traders should trade with the DOWN trend. However, there is a distinct possibility that market participants will either pour in or sell out, and the price can move up or down with big volumes (leading up to the breakout). This pattern is commonly associated with directionless markets, since the contraction (narrowing) of the market range signals that neither bulls nor bears are in control.

Unlike Descending Triangle patterns, however, both lines need to have a distinct downward slope, with the top line having a steeper decline. The Falling Wedge pattern forms when prices appear to spiral downward, with lower lows (1, 3, 5) and lower highs (2, 4) creating two down-sloping trend lines that intersect to form a triangle.

0 kommentar(er)

0 kommentar(er)